The registrant is submitting this draft Registration Statement confidentially as an “emerging growth company”

pursuant to Section 6(e) of the Securities Act of 1933.

As submitted confidentially to the Securities and Exchange Commission on August 14, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Greenlane Holdings, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 5099 | 83-0806637 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (IRS Employer | ||

| incorporation or organization) | Classification Code Number) | Identification No.) |

6501 Park of Commerce Blvd., Suite 200

Boca Raton, FL 33487

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Aaron LoCascio

Chief Executive Officer

6501

Park of Commerce Blvd., Suite 200

Boca Raton, FL 33487

(877) 292-7660

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

Eric M. Hellige, Esq. Jeffrey C. Johnson, Esq. Pryor Cashman LLP 7 Times Square New York, New York 10036 (212) 421-4100 |

Larry W. Nishnick, Esq. Patrick J. O’Malley, Esq. DLA Piper LLP (US) 4365 Executive Drive, Suite 1100 San Diego, California (858) 677-1400 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||||||

| Class A Common Stock, $0.01 par value per share | $ | $ | ||||||

| Underwriters’ Warrants to Purchase Class A Common Stock(3) | ||||||||

| Class A Common Stock Underlying Underwriters’ Warrants, $0.01 par value per share(4) | ||||||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Includes additional shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (3) | In accordance with Rule 457(g) under the Securities Act, because the shares of the registrant’s Class A common stock underlying the Underwriters’ Warrants are registered hereby, no separate registration fee is required with respect to the warrants registered hereby. |

| (4) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. We have agreed to issue to the underwriters warrants to purchase up to 3% of the number of shares of our Class A common stock to be issued and sold in this offering (including shares issuable upon exercise of the over-allotment option described herein). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a) may determine.

EXPLANATORY NOTE

This registration statement contains two forms of prospectus: one to be used in connection with the offering of the securities described herein in the United States, which we refer to as the “U.S. Prospectus,” and one to be used in connection with the offering of such securities in Canada, which we refer to as the “Canadian Prospectus.” The U.S. Prospectus and the Canadian Prospectus are identical except for the cover page, the table of contents and the back page, and except that the Canadian Prospectus includes pages C-1 through C-26, a “Certificate of the Company,” a “Certificate of the Selling Stockholders,” a “Certificate of the Promoters” and a “Certificate of the Canadian Underwriters.” The form of the U.S. Prospectus is included herein and is followed by the alternate and additional pages to be used in the Canadian Prospectus.

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED | , 2018 |

Shares

Greenlane Holdings, Inc.

Class A Common Stock

$ per share

This is the initial public offering of our Class A common stock. We are selling shares of our Class A common stock, and the selling stockholders named in this prospectus are selling shares of our Class A common stock. We currently expect the initial public offering price to be between $ and $ per share of our Class A common stock. The initial public offering price of the shares concurrently being offered in Canada by the Canadian underwriters will be the approximate equivalent in Canadian dollars. We will not receive any proceeds from the sale of shares by the selling stockholders.

Prior to this offering, there has been no public market for our Class A common stock. We have applied to list our Class A common stock on the Canadian Securities Exchange under the symbol “GNLN.”

Following this offering, we will have three classes of authorized common stock. Each share of our Class A common stock, our Class B common stock and our Class C common stock will have one vote per share. Aaron LoCascio, our Chief Executive Officer, and Adam Schoenfeld, our President and Chief Strategy Officer, and an affiliated entity of Messrs. LoCascio and Schoenfeld, will beneficially own all of our issued and outstanding Class C common stock after this offering and will hold in the aggregate approximately % of the combined voting power of our outstanding capital stock after this offering. As a result, Messrs. LoCascio and Schoenfeld will be able to control any action requiring the general approval of our stockholders, including the election of our board of directors, the adoption of amendments to our certificate of incorporation and bylaws and the approval of any merger or sale of substantially all of our assets.

We are an “emerging growth company” as that term is used in the Jumpstart our Business Startups Act of 2012, and as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary—JOBS Act” and “Risk Factors—Risks Related to this Offering and Ownership of Our Class A Common Stock.”

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 20.

| Per Share | Total | |||||||

| Initial Public Offering Price | $ | $ | ||||||

| Underwriting Discounts and Commissions | $ | $ | ||||||

| Proceeds to Us (before expenses) | $ | $ | ||||||

| Proceeds to the Selling Stockholders | $ | $ | ||||||

The selling stockholders have granted the underwriters an option to purchase up to additional shares of our Class A common stock within 30 days of the closing date of this offering to cover any over-allotments, if any, and for market stabilization purposes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2018 through the book-entry facilities of The Depository Trust Company.

Canaccord Genuity

Prospectus dated , 2018

We are responsible for the information contained in this prospectus and in any free-writing prospectus we have authorized. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with different information, and neither we, the selling stockholders nor the underwriters take responsibility for any other information others may give you. Neither we, the selling stockholders nor the underwriters are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our Class A common stock. You should not assume that the information contained in this prospectus is accurate as of any date other than its date.

i

TRADEMARKS

This prospectus contains references to our trademarks and service marks, including without limitation, Greenlane®, Higher Standards®, VapeWorld®, Aerospaced® and Groove®. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. In addition, this prospectus contains trade names, trademarks and service marks of other companies that we do not own. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

GLOSSARY

Set forth below is a glossary of industry and other terms used in this prospectus:

| ● | “we,” “us,” “our,” the “Company,” “Greenlane” and similar references refer: (i) following the completion of the Transactions (as defined below), including this offering, to Greenlane Holdings, Inc., and, unless otherwise stated, all of its subsidiaries, including Greenlane Holdings, LLC, and, unless otherwise stated, all of its subsidiaries, and (ii) prior to the completion of the Transactions, including this offering, to Greenlane Holdings, LLC and, unless otherwise stated, all of its subsidiaries. |

| ● | “Members” refer to the Founder Members and Non-Founder Members, as described below. |

| ● | “Founder Members” refer to Aaron LoCascio, our Chief Executive Officer, Adam Schoenfeld, our President and Chief Strategy Officer, and Jacoby & Co. Inc., an affiliated entity of Messrs. LoCascio and Schoenfeld, each of which will continue to own Common Units (as defined below) after the Transactions and who may, following the completion of this offering, exchange their Common Units for shares of our Class A common stock as described in “Certain Relationships and Related Party Transactions—The Transactions—Greenlane Operating Agreement.” As the context requires in this prospectus, “Founder Members” also refers to the respective successors, assigns and transferees of such Founder Members permitted under the Greenlane Operating Agreement and our amended and restated certificate of incorporation. |

| ● | “Non-Founder Members” refer to those direct and certain indirect owners of interests in Greenlane Holdings, LLC prior to the Transactions, other than the Founder Members, but including the holders of interests that are subject to vesting, each of which will continue to own Common Units after the Transactions and who may, subject to contractual stipulations following the completion of this offering, exchange their Common Units for shares of our Class A common stock as described in “Certain Relationships and Related Party Transactions—The Transactions—Greenlane Operating Agreement.” The Non-Founder Members will include (i) our named executive officers, other than the Founder Members, and (ii) each of our stockholders identified in the table under the caption “Principal and Selling Stockholders” as beneficially owning shares of our Class B common stock. As the context requires in this prospectus, “Non-Founder Members” also refers to the respective successors, assigns and transferees of such Non-Founder Members permitted under the Greenlane Operating Agreement and our amended and restated certificate of incorporation. |

| ● | “Common Units” refer to the single class of issued common membership interests of Greenlane Holdings, LLC. |

| ● | “Greenlane Operating Agreement” refers to Greenlane Holdings, LLC’s third amended and restated operating agreement, which will become effective on or immediately prior to the completion of this offering. |

| ● | “Transactions” refer, unless otherwise stated or the context otherwise requires, to this offering and the other organizational transactions described under the caption “The Transactions.” |

ii

BASIS OF PRESENTATION

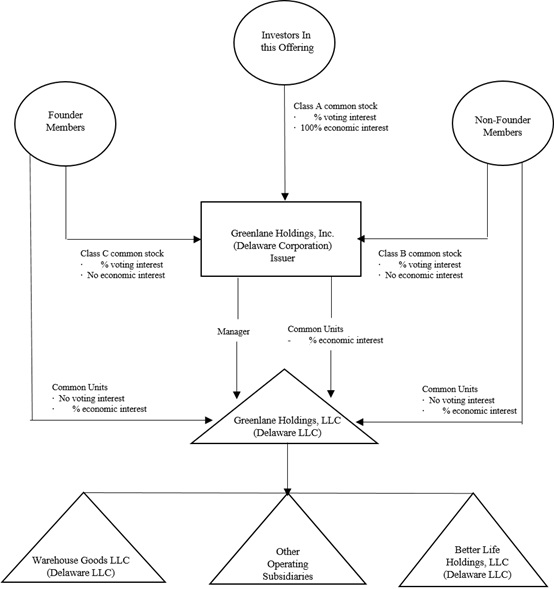

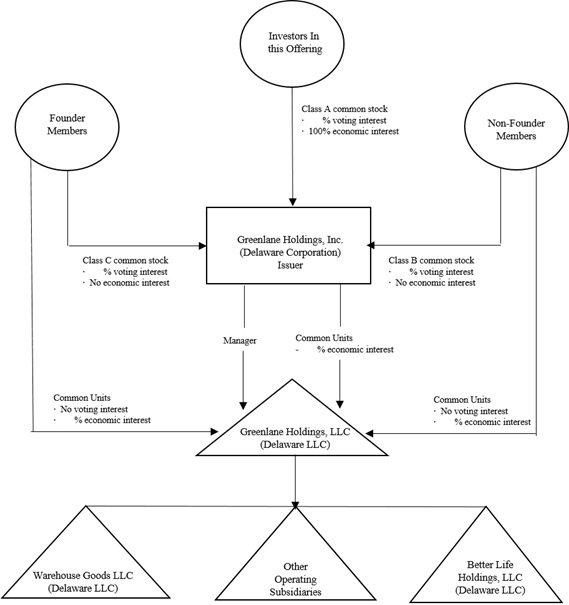

Organizational Structure

In connection with the completion of this offering, we will effect certain organizational transactions, which we refer to collectively as the “Transactions.” See “The Transactions” for a description of the Transactions and a diagram depicting our organizational structure after giving effect to the Transactions, including this offering.

Prior to the completion of this offering and the Transactions, Greenlane Holdings, LLC was owned entirely by the Members and operated its business through itself and various wholly-owned subsidiaries. Greenlane Holdings, Inc. was incorporated as a Delaware corporation on May 2, 2018 to serve as the issuer of the Class A common stock offered in this offering.

Following the Transactions, we will be a holding company and the sole manager of Greenlane Holdings, LLC, and upon completion of this offering and the application of proceeds therefrom, our principal asset will be Common Units. For financial reporting purposes, Greenlane Holdings, LLC is the predecessor of our company. We will be the financial reporting entity following this offering. Accordingly, this prospectus contains the following historical financial statements:

| ● | Greenlane Holdings, LLC. As we will have no other interest in any operations other than those of Greenlane Holdings, LLC and its subsidiaries, the historical consolidated financial information included in this prospectus is that of Greenlane Holdings, LLC and its subsidiaries. |

| ● | Better Life Holdings, LLC. We acquired all of the outstanding securities of Better Life Holdings, LLC a leading west coast distributor of like products, on February 20, 2018 and have included the historical financial information of Better Life Holdings, LLC. |

The unaudited pro forma financial information of our company presented in this prospectus has been derived by the application of pro forma adjustments to the historical consolidated financial statements of Greenlane Holdings, LLC and its subsidiaries included elsewhere in this prospectus. These pro forma adjustments give effect to (i) the organizational transactions described under “The Transactions,” (ii) this offering and the use of proceeds from this offering and (iii) the acquisition by Greenlane Holdings, LLC of Better Life Holdings, LLC on February 20, 2018 as if such acquisition occurred on January 1, 2017. See “Unaudited Pro Forma Consolidated Financial Information” for a complete description of the adjustments and assumptions underlying the pro forma financial information included in this prospectus.

iii

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before deciding to invest in our Class A common stock. You should read this entire prospectus carefully, including “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical and pro forma consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision.

Our Company

Overview

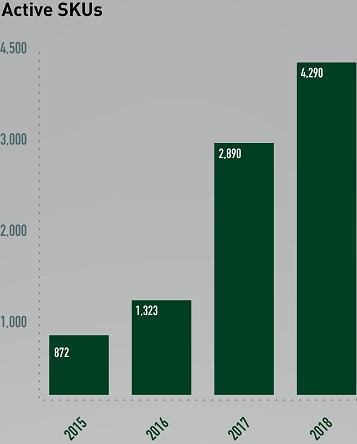

We are the largest distributor of premium vaporization products and consumption accessories in the United States and have a growing presence in Canada. Our customers include over 5,700 independent smoke shops and regional retail chain stores, which collectively operate through an estimated 8,000 retail locations, and hundreds of licensed cannabis cultivators, processors and dispensaries. We also own and operate two of the leading North American direct-to-consumer e-commerce websites in the vaporization products and consumption accessories industry, VaporNation.com and VapeWorld.com, which offer convenient, flexible shopping solutions directly to consumers. Through our expansive North American distribution network and e-commerce presence, we offer a comprehensive selection of more than 4,000 stock keeping units (“SKUs”), including premium vaporizers and parts, cleaning products, grinders and storage containers, pipes, rolling papers and customized lines of premium specialty packaging. We have cultivated a reputation for carrying the highest-quality products from large established manufacturers that offer leading brands, such as the Volcano vaporizers by Storz & Bickel, PAX 3 vaporizers by PAX Labs and JUUL vaporizers by JUUL Labs, as well as promising start-up manufacturers that offer innovative, up-and-coming products, to which we extend the ability to grow and scale quickly. We also provide value-added sales services to complement our product offerings and help our customers operate and grow their businesses. Recently, we have set out to develop a world class portfolio of our own proprietary brands which, over time, will deliver higher margin and create long-term value. We believe our market leadership, distribution network, broad product selection and extensive technical expertise provide us with significant competitive advantages and create a compelling value proposition for both our customers and our suppliers.

Our Customers. We market and sell our products in both the business to business (“B2B”) and business to consumer (“B2C”) sectors of the marketplace. We believe our B2B customers choose us for a number of reasons, including the breadth and availability of the products we offer, our extensive expertise, the quality of our customer service, the convenience of our distribution centers and the consistency of our timely delivery. Our ability to provide a “one-stop shop” experience allows us to be the preferred vendor to many of these customers by streamlining their supply chain. In addition, we believe that our customers find great value in the advice and recommendations provided by our knowledgeable sales and service associates, which further increases demand for our products.

We have a diverse base of more than 5,700 B2B customers, and our top ten customers accounted for 10.9% and 12.9% of our net sales in the year ended December 31, 2017 and the three-month period ended March 31, 2018, respectively, with no single customer accounting for more than 2.0% and 3.5% of our net sales in the year ended December 31, 2017 and the three-month period ended March 31, 2018, respectively. While we distribute our products to a growing number of large national and regional retailers in Canada, our typical B2B customer is an independent retailer operating in a single market. Our customer service teams interact regularly with our B2B customers as most of them have frequent restocking needs. We believe our high-touch customer service model strengthens relationships, builds loyalty and drives repeat business. In addition, we believe our premium product lines, broad product portfolio and strategically-located distribution centers position us well to meet our customers’ needs and ensure timely delivery of products.

We also have a large base of B2C customers who we reach via our VaporNation.com and VapeWorld.com websites. While these customers are predominantly in North America, we also ship to Europe, Australia and other select regions. Our websites are among the most trafficked within our segment according to Alexa Traffic Rankings, and as of March 31, 2018, we ranked first in over 15 Google key search terms and in the top five in over 150 Google key search terms. These websites currently attract over 360,000 unique monthly visitors and generate approximately 6,000 monthly transactions. We shipped more than 180,000 parcels to our B2C customers during the year ended December 31, 2017 and more than 57,000 parcels during the three-month period ended March 31, 2018. In addition to our e-commerce platform, in 2018 we opened our first retail location in the high-traffic shopping center, Chelsea Market, in New York City under our proprietary Higher Standards brand.

In the first quarter of 2018, our B2B revenues represented approximately 82.1% of our net sales, our B2C revenues represented approximately 10.9% of our net sales, and the balance of our net sales was comprised of revenues derived from drop-shipping on behalf of other website operators and providing other services.

Our Suppliers. Our strong supplier relationships allow us to distribute a broad selection of in-demand premium products at attractive prices. We are the exclusive or lead distributor for many of our suppliers due to our scale, nationwide footprint, leading market positions, knowledgeable professionals, high service levels and strong customer relationships. We believe many of our suppliers choose us because of our track record for successfully growing and launching brands in our trade channels. We offer suppliers feedback and support through all stages of the product sale cycle, including customer service and warranty support. We are often the largest or most visible exhibitor at industry trade shows where we work closely with our premium suppliers in presenting, demonstrating and exposing their products. We believe these value-added services foster an ongoing and lasting relationship with our suppliers, and they serve as a key element of our business strategy.

1

We source our products from more than 125 suppliers, including leading vaporizer equipment manufacturers, a wide range of smaller companies that are applying breakthrough innovations for up-and-coming products, and a variety of suppliers that specialize in low or no-technology industry-staple products, such as rolling papers, cleaning supplies and child-resistant packaging. We have exclusive or lead distribution relationships with some of our largest suppliers, including North America channel exclusivity for Pax Lab’s Pax 2 and 3 products, U.S. exclusivity for the full line of Storz & Bickel products (Volcano, Plenty, Mighty and Crafty), worldwide exclusivity for all Grenco Science products, and other geographic exclusivity with Da Vinci, Pollen Gear, Banana Bros, Eyce and others. We are also one of the largest distributors of products made by JUUL Labs. We believe our exclusive and lead distribution relationships are a principal competitive advantage. Additionally, we develop and sell innovative products under our proprietary brands, such as Higher Standards. Our portfolio of highly-regarded brands helps us to attract and retain our B2B and B2C customers, which allows us to generate incremental sales opportunities.

Our Distribution Facilities. In 2017, we shipped more than 225,000 parcels comprising more than 2.0 million product units. To facilitate these volumes and in anticipation of future growth, we have established a network of five strategically-located distribution centers that provide full coverage of the United States and Canada and ensure timely and cost-effective transportation and delivery of our products. We estimate that, as of March 31, 2018, 90% of our North American customers could be reached within two days via FedEx Ground or similar ground delivery services. Due to our mature and continuously-evolving operational efficiencies, we provide our customers with accurate transaction fulfillment, logistics and customer support services. We expect to open an additional distribution facility in British Columbia, Canada, in the third quarter of 2018.

Our Growth. In February 2018, we completed the acquisition of Better Life Holdings, LLC, a leading west coast distributor of like products that does business under the trade name VaporNation, to expand and grow our business and market leadership. We intend to pursue additional acquisitions to complement our organic growth and to achieve our strategic objectives. Since July 1, 2016, we have grown our employee count from 89 employees to 220 employees as of June 1, 2018, of which 75 were focused on sales. Our organic and acquisition-driven growth strategies have led to significant increases in consolidated net sales, gross profit and EBITDA. For the three-month period ended March 31, 2018, which included the results of Better Life Holdings, LLC only for the period commencing on February 20, 2018 we generated consolidated net sales of $43.3 million, gross profit of $9.1 million and EBITDA of $2.7 million, compared to net sales of $19.2 million, gross profit of $4.4 million and EBITDA of $0.8 million for the three-month period ended March 31, 2017. For the year ended December 31, 2017, without any pro forma adjustment for our acquisition of Better Life Holdings, LLC, we generated consolidated net sales of $88.3 million, gross profit of $20.6 million and EBITDA of $3.5 million, compared to consolidated net sales of $66.7 million, gross profit of $15.0 million and EBITDA of $1.0 million for the year ended December 31, 2016. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measure-EBITDA” for a reconciliation of our EBITDA to net income.

Investment Highlights

Leading Distributor of Premium Vaporization Products and Consumption Accessories in North America

We are the largest distributor of premium vaporization products and consumption accessories in the United States and have a growing presence in Canada. We have exclusive rights from a number of suppliers to distribute premium brands and products. As of March 31, 2018, we carried more than 4,000 SKUs that were sourced from more than 125 suppliers. For the year ended December 31, 2017 and the three-month period ended March 31, 2018, we had consolidated net sales of $88.3 million and $43.3 million, respectively, and we believe we are positioned to grow substantially as the cannabis regulatory landscape evolves.

Strong and Loyal Customer Base with Robust Sales Infrastructure to Support Scale

Our B2B customers include over 5,700 independent smoke shops and regional retail chain stores, which collectively operate through an estimated 8,000 retail locations, and hundreds of licensed cannabis producers, processors and dispensaries. We intend to further expand into new or recently-entered trade channels, including mass retail and big box. We believe our highly-specialized sales force and robust infrastructure are well-positioned to support this growth. We invest in our talent by providing every sales representative with an extensive and ongoing education, including programs that provide comprehensive product knowledge, as well as the tools needed to have a unique understanding of our customers’ personalities and decision-making processes.

A Significant E-Commerce Retailer Positioned to Become a Global Leader in Direct-to-Consumer

We own and operate two of the leading North American direct-to-consumer e-commerce websites in our industry, VaporNation.com and VapeWorld.com. Our e-commerce properties increase our reach on a global scale and provide better gross profit margins than our B2B operations. With a database consisting of more than 260,000 B2C customers, we are able to continually expand our audience and business. In addition to our own fulfillment, we also exclusively fulfill web orders for many of the top industry suppliers, as well as for other leading e-commerce websites. We are developing a unique e-commerce platform, Vapor.com, that should further increase our leadership position in the direct-to-consumer channel.

Strategically-Located Distribution Footprint

We have established our distribution network across the U.S. and Canada, including five distribution centers that allow us to deliver to approximately 90% of our customers within two days via FedEx Ground or similar ground delivery services. In the 12 months ended March 31, 2018, our expansive distribution network allowed us to ship over 257,000 parcels comprising over 4.1 million product units. Our infrastructure is built to support our company as it grows and scales. We believe our distribution network would be difficult and expensive for new entrants in our industry to replicate.

2

Demonstrated Strong Financial Performance and Future Growth Prospects

We have operated profitably since our inception in 2005. We believe our products are best-in-class and our “white glove” customer service, complemented by our prudent financial management, have driven strong growth and financial performance. We emphasize and incentivize profitability at the transaction level and foster relationships with customers to drive repeat purchasing. We have achieved revenue growth of 32.3% for the year ended December 31, 2017 (“fiscal 2017”) compared to the prior year period.

| ● | Total revenue increased from $66.7 million in the year ended December 31, 2016 (“fiscal 2016”) to $88.3 million in fiscal 2017, representing an annual growth rate of 32.3%, or to $104.6 million in fiscal 2017 on a pro forma basis giving effect to our acquisition of Better Life Holdings, LLC in February 2018, representing a growth rate of 56.8%. |

| ● | Total revenue increased from $19.2 million in the quarter ended March 31, 2017 (“Q1 2017”) to $43.3 million in the quarter ended March 31, 2018 (“Q1 2018”), representing an increase of 125.5%. |

| ● | Net income was $87,000 for fiscal 2016 and $2.3 million for fiscal 2017. |

| ● | EBITDA increased from $1.0 million in the year ended December 31, 2016 to $3.5 million for fiscal 2017, representing an annual growth rate of 250.0%. |

We believe our results of operations for Q1 2018 are a first look at our future growth prospects as we continue to rapidly scale and execute on new growth opportunities. We experienced revenue growth of 125.5% for Q1 2018 compared to Q1 2017.

Passionate and Committed Executive Team with Proven Track Record of Delivering Strong Results

Our executive team has over 225 years of cumulative experience across various industries, including distribution, marketing, sales, financial services, public accounting, logistics, information technology, and luxury retail. Through steady brand discipline and strategic business planning, our executive team has transformed a small, single-product distributor into a leading multi-product, omni-channel distributor with a diverse and strategic portfolio mix of premium brands and products. Our executive team’s passion and dedication to our company permeates across our employees and organizational culture, which fosters innovation, teamwork, passion for our products and personalized customer service.

Our Business Relating to the Cannabis Industry

While we do not cultivate, distribute or dispense cannabis or any cannabis derivatives, several of the products we distribute may be used for the consumption of cannabis, cannabis derivatives and nicotine using items such as vaporizers, pipes and rolling papers.

We

believe the global cannabis industry is experiencing a transformation from a state of prohibition toward a state of legalization.

We expect the number of states, countries and other jurisdictions implementing legalization legislation to continue to increase,

which will create numerous and sizable opportunities for market participants, including us. Further, we believe that the trend

of users seeking to consume nicotine will continue to evolve from traditional cigarettes to e-cigarettes, vaporizers and heat-not-burn

platforms a trend which we are well-positioned to capitalize on.

Global Landscape

A June 2018 report of Arcview Market Research, a leading market research firm in the cannabis industry, projects that spending in the global legal cannabis market will be approximately $12.9 billion in 2018, of which the United States, Canada and rest of the world are projected to comprise $11 billion, $1.3 billion and $0.6 billion, respectively, and projects that by 2022 spending in the global legal cannabis market will reach $32.0 billion, of which the United States, Canada and rest of the world comprises $23.4 billion, $5.5 billion and $3.1 billion, respectively.

Wells Fargo Securities, LLC believes the global e-cigarette and vapor market will generate $5.5 billion of revenue in 2018, of which vaporizers, tanks and mods are projected to comprise $3.5 billion.

Our

experience and awareness of the markets in which we operate lead us to believe that demand for the types of products we distribute

will grow in tandem with the industry.

The North American Cannabis Landscape

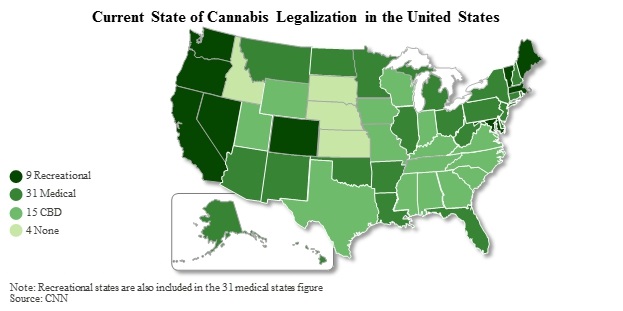

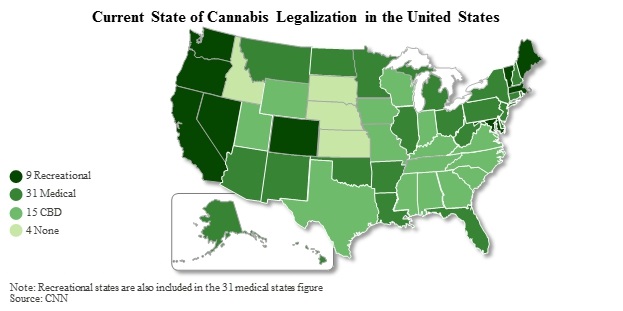

United States and Territories. Thirty-one states, the District of Columbia, Puerto Rico, and Guam have legalized medical cannabis in some form, although not all of those jurisdictions have fully implemented their legalization programs. Nine of these states and the District of Columbia have legalized cannabis for non-medical adult use. Fifteen additional states have legalized high-cannabidiol (CBD), low tetrahydrocannabinol (THC) oils for a limited class of patients. Only four states continue to prohibit cannabis entirely. Notwithstanding the continued trend toward further state legalization, cannabis continues to be categorized as a Schedule I controlled substance under the Federal Controlled Substances Act (the “CSA”) and, accordingly, the cultivation, processing, distribution, sale and possession of cannabis violate federal law in the United States as discussed further in “Risk Factors—Our business depends partly on continued purchases by businesses and individuals selling or using cannabis pursuant to state laws in the United States or Canadian and provincial laws.”

3

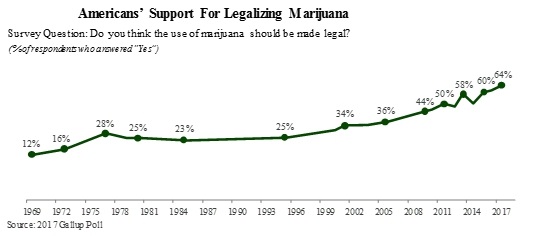

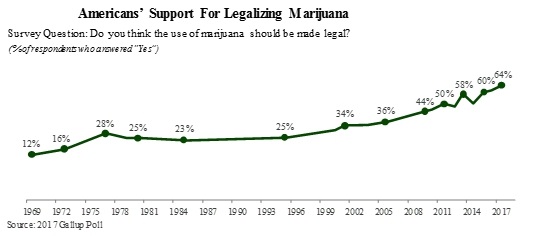

We believe support for cannabis legalization in the United States is gaining momentum. According to a 2017 poll by Gallup, public support for the legalization of cannabis in the United States has increased from approximately 16% in 1974 to approximately 64% in 2017.

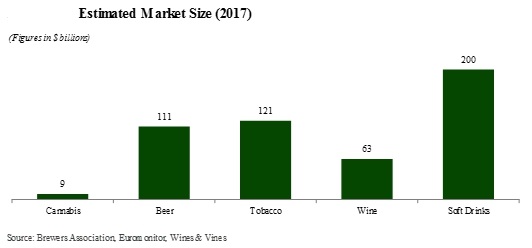

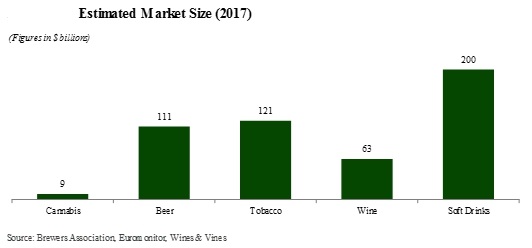

The U.S. cannabis industry has experienced significant growth over the past 12 months fueled in part by increasing consumer acceptance and the legalization of medical and recreational cannabis across the United States. A May 2018 research report of Cowen and Company, a diversified financial services firm, estimated the United States to have 34 million adult cannabis users and projects that this number will grow to approximately 43 million in 2022 and 58 million by 2030. However, many of these consumers do not reside in states where recreational or medical cannabis is legal under applicable state law. With increasing adult usage and further states expecting to legalize recreational cannabis use, some business participants in sectors such as wine, beer, spirits and tobacco have publicly expressed their views on the threats to their businesses from the growth of the cannabis industry.

4

The following map illustrates states that have fully legalized cannabis (for medical and recreational purposes); have partially legalized cannabis (for medical purposes only); and have not legalized cannabis for medical or recreational purposes are outlined below (as of August 1, 2018).

Canada. Legal access to dried cannabis for medical purposes was first allowed in Canada in 1999. The Access to Cannabis for Medical Purposes Regulations currently govern the production, sale and distribution of cannabis products in Canada. Health Canada recently reported that over 235,000 patients had registered for medical cannabis prescription by September 30, 2017.

On April 13, 2017, the Government of Canada introduced legislation to legalize and regulate access to cannabis (“Bill C -45”). The Cannabis Act (Canada) (the “Cannabis Act”) created a strict legal framework for controlling the production, distribution, sale and possession of cannabis in Canada. On June 21, 2018, the Government of Canada announced that Bill C-45, an Act respecting cannabis and to amend the Controlled Drugs and Substances Act, the Criminal Code and other Acts, received Royal Assent and Prime Minister Trudeau announced that marijuana would be legal and available to the consuming public by October 2018.

In

a 2018 publication by Deloitte, a leading professional services and consulting firm, the projected size of the Canadian

adult-use market in 2019 ranged from C$1.8 billion to C$4.3 billion and in a 2018 research report, CIBC

World Markets indicated that it expects the sector to grow to C$6.5 billion by 2020.

The outlook for the North American cannabis industry is largely positive. The industry is expected to continue benefiting from increasingly-favorable attitudes toward both medical cannabis and recreational cannabis with expected significant consumer spending increases.

The International Cannabis Landscape

Europe. Europe’s

population is more than twice the size of the U.S. and Canadian markets combined, suggesting the potential of a very

significant market. Prohibition Partners, a London-based strategic consultancy firm, estimated in 2018 that approximately 12%

of the continent’s adult population were “irregular” or “intensive” users of cannabis and

a fully-regulated cannabis market would be worth more than $70 billion annually, with medical usage comprising $46

billion.

Currently, only Germany, Italy, Austria, Czech Republic, Finland, Portugal, Poland and Spain allow cannabis use for medicinal purposes, although it has been widely reported that other countries are considering following suit.

5

The progress of some key international markets is outlined below.

Germany. In January 2017, the German parliament legalized cannabis for medical consumption. In Germany, the cost of dried cannabis and cannabis extracts will be covered by health insurance for patients who have no other treatment options. Germany has created a “Cannabis Agency” to regulate the formation of a domestic cultivation and production of the medical cannabis supply chain. According to Rheinische Post, in the first 10 months of Germany’s medical cannabis reform, over 13,000 applications for medical cannabis have been received by the largest three public health insurance companies in Germany.

United Kingdom. The U.K is a global leader in legal cannabis production according to the International Narcotics Control Board and the country has also positioned itself as being in the forefront of medical cannabis research and development. The U.K has launched a review into the status of cannabis, which is currently classified as a Class B drug, the second most harmful category of narcotics.

Australia. In February 2016, Australia legalized medical cannabis at the federal level to allow for the manufacturing of medicinal cannabis products in Australia. In October 2016, the Australian regulatory authority released a detailed application process to license domestic cultivators and producers of medical cannabis. In the interim, until local licenses have been awarded and have reached production capacity, Australia is allowing medical cannabis to be imported from locally-authorized producers. In January 2018, the Australian government announced that it will now permit the export of medicinal cannabis products to provide increasing opportunities for domestic producers.

Israel. In February 2017, legislation was passed allowing Israeli cannabis companies to export cannabis internationally. According to the country’s health minister, as of December 2017, there are 383 farmers that had applied for growing licenses in Israel, and 250 nurseries, 95 pharmacies and 60 processing facilities had applied for cannabis distribution and/or processing licenses. According to the European Journal of Internal Medicine, as of March 2018, there was estimated to be 32,000 registered users of medical cannabis in Israel. Recreational cannabis use is currently illegal in Israel, but it is expected to be decriminalized by late 2018.

Uruguay. In December 2013, Uruguay became the first country to legalize cannabis for both medicinal and recreational purposes. According to a news report published by The Independent, as of December 2017, there were over 16,000 government - registered cannabis users, a three-fold increase from approximately 5,000 users in July 2017.

Product Information

Consumers of cannabis, herbs, flavored compounds and nicotine are likely going to require the types of products we distribute, including vaporizers, pipes, rolling papers and packaging. We believe we distribute the “picks & shovels” for these rapidly-growing industries.

Inhalation Delivery Methods. There are two prevalent types of inhalation methods for cannabis and nicotine—combustion and vaporization. Recent advances in vaporization technology offer users a cleaner alternative to combustion with fewer health concerns.

Vaporizers are personal devices that heat materials to temperatures below the point of combustion, extracting the flavors, aromas and effects of dry herbs and concentrates in the form of vapor. Measured by revenue, vaporizers are our largest product category. In 2017, the vaporizers and components category, which is comprised of desktops, portables and pens, generated 79.9% of our net sales.

The Science and Popularity of Vaporization

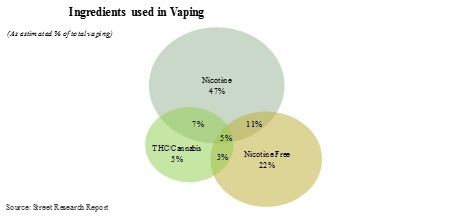

Vaporizers have elements that are designed to quickly heat combustible material, which generates a vapor that is immediately inhaled through the mouthpiece on the device itself, or a hose, pipe or an inflatable bag. Vaporizers can heat a variety of dry materials, viscous liquids and waxes and provides a convenient way for users to consume the active ingredients. Common ingredients used in vaporizers include cannabis, nicotine extracts, tobacco, herbs and propylene glycol and glycerin blends.

6

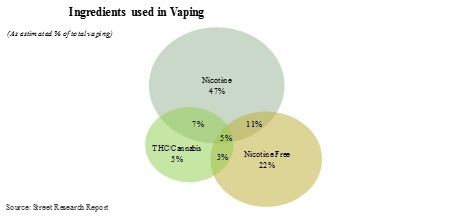

Vaporizers have become a popular way to consume cannabis, flavored compounds and nicotine. According to the Cowen Vaping Survey conducted in April 2016, cannabis users comprised 20% of the vaporizer market. Heating rather than burning cannabis affords the consumer more control over the substances being consumed as vaporizers produce no smoke, are more discreet and emit less odor compared to combustible methods of consumption. As a result, vaporizers are expected to gain significantly more market share.

Currently, vaporization technology is utilized for the following substances:

Vaporization Technology. Cannabis consumers have a wide array of vaporization devices at their disposal, which can be broadly categorized into two primary segments—desktop and portable vaporizers. Our vaporizer offering spans over 250 distinct products across 56 brands.

Desktop Vaporizers. Vaporizers were first developed as desktop models that were powered through traditional electric power sources. Desktop vaporizers are capable of heating the material to a more precise temperature choice determined by the consumer or as advised by a health practitioner. Some models dispense the vapor through a pipe or wand, and others into an inflatable bag in order to allow users to more accurately monitor their consumption.

Portable Vaporizers. With the development of lithium batteries, vaporizers have now become portable. Technological advances are resulting in lighter, sleeker and more visually-appealing units that are capable of quickly heating the material to the user’s desired temperature setting. The temperature setting can be fixed by the manufacturer or set manually by the consumer or via a Bluetooth connection to the consumer’s smartphone. Portable vaporizers, of which pens are a sub-set, are differentiated by many features, including output, battery life, recharge time, material, capacity and design.

Other Methods of Consumption. In addition to vaporizers, consumers have a wide array of methods of consumption at their disposal, including, among others, hand pipes, water pipes, rolling papers, and oral and topical delivery methods.

Hand and Water Pipes. We offer a diverse portfolio of approximately 114 products and seven brands, including our own proprietary Higher Standards brand. Many display iconic, licensed logos and artwork as pipes have grown into an artistic expression and are available in countless creative forms and functionality.

Hand pipes are small, portable and simple to use and function by trapping the smoke produced from burning materials, which is then inhaled by the user. Water pipes include large table-top models and bubblers and are more complex because they incorporate the cooling effects of water to the burning materials, before inhalation.

Rolling Papers. Rolling papers are a traditional consumption method used to smoke dried plant material in a “roll-your-own application”. Our rolling papers category is comprised of approximately 50 products across six brands.

Edibles, Tinctures, Ingestible Oils and Topicals are additional methods of consumption.

7

Our Competitive Strengths

We attribute our success to the following competitive strengths.

Clear Market Leader in an Attractive Industry. We are the largest North American distributor of premium vaporization products and consumption accessories.

Market Knowledge and Understanding. Because of our experience and our extensive and long-term industry relationships, we believe we have a deep understanding of customer needs and desires in both our B2B and B2C channels. This allows us to influence customer demand and to insert ourselves in the pipeline between product manufacturers, suppliers, advertisers and the marketplace.

Broadest Product Offering. We believe we offer the industry’s most comprehensive portfolio of vaporization products and consumption accessories with over 4,000 SKUs from more than 125 suppliers. This broad product offering creates a “one-stop” shop for our customers and positively distinguishes us from our competitors. In addition, we have carefully cultivated a portfolio of well-known brands and premium products, and have helped many of the brands we distribute to become established names in the industry.

Entrepreneurial Culture. We believe our entrepreneurial, results-driven culture fosters highly-dedicated employees who provide our customers with superior service that differentiates us from our competition. We invest in our talent by providing every sales representative with an extensive and ongoing education, and have successfully developed programs that provide comprehensive product knowledge, as well as the tools needed to have a unique understanding of our customers’ personalities and decision-making processes.

Unwavering Focus on Relationships and Superior Service. We aim to be the premier partner of choice for our customers, suppliers and employees.

| ● | Customers. We believe we offer superior services and solutions due to our comprehensive product offering, proprietary industry data and analytics, product expertise and the quality of our service. We deliver products to our customers in a precise, safe and timely manner with complementary support from our dedicated sales and service teams. |

| ● | Suppliers. Our industry knowledge, market reach and resources allow us to establish trusted professional relationships with many of our product suppliers. We offer them a variety of value-added services, such as marketing support, supply chain management, customer feedback, market data and customer service to support the sale of their products. |

| ● | Employees. We provide our employees with an entrepreneurial culture, a safe work environment, financial incentives and career development opportunities. |

Experienced and Proven Management Team Driving Organic and Acquisition Growth. We believe our management team is among the most experienced in the industry. Our senior management team brings experience in accounting, mergers and acquisitions, financial services, consumer packaged goods, retail operations, third-party logistics, information technology, product development and specialty retail, and an understanding of the cultural nuances of the sectors that we serve.

8

Our Strategies

We intend to leverage our competitive strengths to increase shareholder value through the following core strategies:

Build Upon Strong Customer and Supplier Relationships to Expand Organically. Our North American footprint and broad supplier relationships, combined with our regular interaction with our large and diverse customer base, provides us key insights and positions us to be a critical link in the supply chain for premium vaporization products and consumption accessories. Our suppliers benefit from access to more than 5,700 B2B customers and more than 260,000 B2C customers as we are a single point of contact for improved production, planning and efficiency. Our customers, in turn, benefit from our market leadership, talented sales associates, broad product offering and high inventory availability, timely delivery and complementary value-added services. We believe our strong customer and supplier relationships will enable us to expand and broaden our market share in the premium vaporization products and consumption accessories marketplace.

Expand Our Operations Internationally. We currently focus our marketing and sales efforts on the United States and Canada, the two largest and most developed markets for our products. While we currently support and ship products to customers in Europe, Australia, and parts of South America on a limited basis, we are aware of the growth opportunities in these markets. As we continue to expand our marketing, supplier relationships, sales bandwidth and expertise, we anticipate capturing market share in those regions by opening our own distribution centers, acquiring existing international distributors and partnering with local operators.

Expand our E-Commerce Reach and Capabilities. We own and operate two of the leading direct-to-consumer e-commerce websites in our industry, VaporNation.com and VapeWorld.com. These sites are the most trafficked within our segment according to Alexa Traffic Rankings, a leading data analytics firm, and as of March 31, 2018, we ranked first in over 15 Google key search terms and over 150 in the top five key search term positions. We intend to continue to optimize our e-commerce platforms to improve conversion rates, increase average order values, and grow our margins.

Pursue Value-Enhancing Strategic Acquisitions. Through our recently-completed acquisition of Better Life Holdings, LLC, we have added new markets within the United States, new product lines, talented employees and operational best practices. We intend to continue pursuing strategic acquisitions to grow our market share and enhance leadership positions by taking advantage of our scale, operational experience and acquisition know-how to pursue and integrate attractive targets. We believe we have significant opportunities to add product categories through our knowledge of our industry and possible acquisition targets.

Enhance Our Operating Margins. We expect to enhance our operating margins as our business expands through a combination of additional product purchasing discounts, reduced inbound and outbound shipping and handling rates, reduced transaction processing fees, increased operating efficiencies and realizing the benefits of leveraging our existing assets and distribution facilities. Additionally, we expect that our operating margins will increase as our product mix continues to evolve to include a greater portion of our proprietary branded products. We are committed to supporting our proprietary brands, such as Higher Standards, which offer better price points and significantly higher gross margins than supplier-branded products.

Developing A World-Class Portfolio of Proprietary Brands. We intend to develop a portfolio of our own proprietary brands, which over time should improve our blended margins and create long-term value. Our brand development will be based upon our proprietary industry intelligence that allows us to identify market opportunities for new brands and products. We plan to leverage our distribution infrastructure and customer relationships to penetrate the market quickly with our proprietary brands and to gain placement in thousands of stores. In addition, we plan to sell such products directly to consumers via the brand websites and our e-commerce properties. Our existing proprietary brands include our Higher Standards and Aerospaced brands. We have short term plans to introduce a brand in partnership with the estate of the iconic artist Keith Haring and a rolling paper brand with one of the most influential celebrities in the industry today. In addition, we are absorbing the Marley Natural accessory line as a house brand. In creating our proprietary brands, we intend to stay mindful of our key supplier relationships and to identify opportunities within our product portfolio and in the market where we can introduce compelling products that do not directly compete with the products of our core suppliers. We believe that, over time, our proprietary brands will have a significant positive impact on our results of operations.

Execute on Identified Operational Initiatives. We continue to evaluate operational initiatives to improve our profitability, enhance our supply chain efficiency, strengthen our pricing and category management capabilities, streamline and refine our marketing process and invest in more sophisticated information technology systems and data analytics. In addition, we continue to further automate our distribution facilities and improve our logistical capabilities. We believe we will continue to benefit from these and other operational improvements.

Be the Employer of Choice. We believe our employees are the key drivers of our success, and we aim to recruit, train, promote and retain the most talented and success-driven personnel in the industry. Our size and scale enable us to offer structured training and career path opportunities for our employees, while in our sales and marketing teams, we have built a vibrant and entrepreneurial culture that rewards performance. We are committed to being the employer of choice in our industry.

9

Reorganization Transactions

Prior to the completion of this offering and the Transactions described below, Greenlane Holdings, LLC was owned entirely by the Members and operated its business through itself and various wholly-owned subsidiaries. Greenlane Holdings, Inc. was incorporated as a Delaware corporation on May 2, 2018, to serve as the issuer of the Class A common stock offered in this offering.

In connection with the completion of this offering, we will consummate the following organizational transactions:

| ● | we will amend and restate Greenlane Holdings, LLC’s existing operating agreement effective as of the completion of this offering to, among other things, convert the Members’ existing interests in Greenlane Holdings, LLC into Common Units and appoint Greenlane Holdings, Inc. as the sole manager of Greenlane Holdings, LLC; |

| ● | we will amend and restate our certificate of incorporation to, among other things, provide for Class A common stock, Class B common stock and Class C common stock; |

| ● | we will issue shares of Class B common stock to the Non-Founder Members on a one-to-one basis with the number of Common Units they own, for nominal consideration, and shares of Class C common stock to the Founder Members on a three-to-one basis with the number of Common Units they own, for nominal consideration; |

| ● | we will issue shares of our Class A common stock, or shares if the underwriters exercise in full their option to purchase additional shares of Class A common stock, assuming an initial public offering price at the midpoint of the price range set forth on the cover page, to the Members upon exchange of an equal number of Common Units, which shares will be sold by the Members as selling stockholders in this offering; |

| ● | we will issue shares of our Class A common stock to the purchasers in this offering, assuming an initial public offering price at the midpoint of the price range set forth on the cover page, and will use all of the net proceeds received by us from such issuance to acquire Common Units from Greenlane Holdings, LLC at a purchase price per Common Unit equal to the initial public offering price per share of Class A common stock, less underwriting discounts and commissions, which Common Units, when added to the Common Units we receive from the selling stockholders, will collectively represent % of Greenlane Holdings, LLC’s outstanding Common Units following this offering, or approximately % if the underwriters exercise in full their option to purchase additional shares of Class A common stock from the selling stockholders; |

| ● | Greenlane Holdings, LLC intends to use the proceeds from the sale of Common Units to Greenlane Holdings, Inc. as described in “Use of Proceeds,” including to pay the expenses of this offering and for acquisitions of complementary businesses, acquisitions of proprietary brands, dispensary service infrastructure and licenses, capital expenditures for operations and warehouses and other facilities, inventory investment, and working capital and general corporate purposes; |

| ● | the Members will continue to own their Common Units not exchanged for the shares of Series A common stock to be sold by them in this offering and will have no economic interests in Greenlane Holdings, Inc. despite their ownership of Class B common stock and Class C common stock, where “economic interests” means the right to receive any distributions or dividends, whether cash or stock, nor any proceeds upon dissolution, winding up or liquidation; and |

| ● | Greenlane Holdings, Inc. will enter into (i) a Tax Receivable Agreement with Greenlane Holdings, LLC and the Members and (ii) a Registration Rights Agreement with the Members who, assuming that all of the Common Units of such Members are redeemed or exchanged for newly issued shares of Class A common stock on a one-to-one basis, will own shares of Greenlane Holdings, Inc.’s Class A common stock, assuming an initial public offering price at the midpoint of the price range set forth on the cover page, representing approximately % of the combined voting power of all of Greenlane Holdings, Inc.’s common stock, or approximately % if the underwriters exercise in full their option to purchase additional shares of Class A common stock. Although the actual timing and amount of any payments that we make to the Members under the Tax Receivable Agreement will vary, we expect those payments will be significant. |

Following this offering, Common Units will be redeemable subject to contractual restrictions at the election of such Members for newly-issued shares of Class A common stock on a one-to-one basis (and their shares of Class B common stock or Class C common stock, as the case may be, will be cancelled on a one-to-one basis in the case of Class B common stock or three-to-one basis in the case of Class C common stock upon any such issuance). We will have the option to instead make a cash payment equal to a volume weighted average market price of one share of Class A common stock for each Common Unit redeemed (subject to customary adjustments, including for stock splits, stock dividends and reclassifications) in accordance with the terms of the Greenlane Operating Agreement. Our decision to make a cash payment upon a Member’s election will be made by our independent directors (within the meaning of applicable securities laws) who are disinterested.

10

Our corporate structure following this offering, as described above, is commonly referred to as an “Up-C” structure, which is often used by partnerships and limited liability companies when they undertake an initial public offering of their business. The Up-C structure will allow the Members to continue to realize tax benefits associated with owning interests in an entity that is treated as a partnership, or “pass-through” entity, for income tax purposes following this offering. One of these benefits is that future taxable income of Greenlane Holdings, LLC that is allocated to the Members will be taxed on a flow-through basis and therefore will not be subject to corporate taxes at the entity level. Additionally, because the Members may redeem their Common Units for shares of our Class A common stock or, at our option, for cash, the Up-C structure also provides the Members with potential liquidity that holders of non-publicly-traded limited liability companies are not typically afforded. See “The Transactions” and “Description of Capital Stock.”

Greenlane Holdings, Inc. will receive the same benefits as the Members on account of our ownership of Common Units in an entity treated as a partnership, or “pass-through” entity, for income tax purposes. As we redeem additional Common Units from the Members under the mechanism described above, we will obtain a step-up in tax basis in our share of Greenlane Holdings, LLC’s assets. This step-up in tax basis will provide us with certain tax benefits, such as future depreciation and amortization deductions that can reduce the taxable income allocable to us. We expect to enter into the Tax Receivable Agreement with Greenlane Holdings, LLC and each of the Members that will provide for the payment by us to the Members of 85% of the amount of tax benefits, if any, that we actually realize (or in some cases are deemed to realize) as a result of (i) increases in tax basis resulting from the redemption of Common Units and (ii) certain other tax benefits attributable to payments made under the Tax Receivable Agreement.

We refer to the foregoing distribution and organizational transactions collectively as the Transactions. For more information regarding our structure after the completion of the Transactions, including this offering, see “The Transactions.”

Immediately following this offering, we will be a holding company and our principal asset will be the Common Units we purchase from Greenlane Holdings, LLC. As the sole manager of Greenlane Holdings, LLC, we will operate and control all of the business and affairs of Greenlane Holdings, LLC and, through Greenlane Holdings, LLC and its subsidiaries, conduct our business. Although we will have a minority economic interest in Greenlane Holdings, LLC, we will have the sole voting interest in, and control the management of, Greenlane Holdings, LLC, and will have the obligation to absorb losses of, and receive benefits from, Greenlane Holdings, LLC that could be significant. As a result, we have determined that, after the Transactions, Greenlane Holdings, LLC will be a variable interest entity, or VIE, and that we will be the primary beneficiary of Greenlane Holdings, LLC. Accordingly, pursuant to the VIE accounting model, we will consolidate Greenlane Holdings, LLC in our consolidated financial statements and will report a non-controlling interest related to the Common Units held by the Members on our consolidated financial statements.

See “Description of Capital Stock” for more information about our amended and restated certificate of incorporation and the terms of the Class A common stock, Class B common stock and Class C common stock. See “Certain Relationships and Related Party Transactions” for more information about:

| ● | the Greenlane Operating Agreement, including the terms of the Common Units and the redemption right of the Members; |

| ● | the Tax Receivable Agreement; and |

| ● | the Registration Rights Agreement. |

11

The following diagram shows our organizational structure after giving effect to the Transactions, including this offering, assuming an initial public offering price at the midpoint of the price range set forth on the cover page and no exercise by the underwriters of their option to purchase additional shares of Class A common stock:

JOBS Act

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier to occur of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion or (c) in which we become a large accelerated filer, which means that we have been public for at least 12 months, have filed at least one annual report and the market value of our Class A common stock that is held by non-affiliates exceeds $700 million as of the last day of our then most recently completed second fiscal quarter and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 as the “JOBS Act,” and references to “emerging growth company” have the meaning given to such term in the JOBS Act.

12

An emerging growth company may take advantage of specified exemptions from various requirements that are otherwise generally applicable to public companies in the United States. These provisions include:

| ● | an exemption to include in an initial public offering registration statement less than five years of selected financial data; and |

| ● | an exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting. |

We have availed ourselves in this prospectus of the reduced reporting requirements described above with respect to selected financial data. As a result, the information that we are providing to you may be less comprehensive than what you might receive from other public companies.

In addition, the JOBS Act provides that an emerging growth company may delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. Therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Corporate Information

We were incorporated as a Delaware corporation on May 2, 2018 for the purpose of issuing the Class A common stock in this offering and acquiring Common Units in Greenlane Holdings, LLC, our principal operating subsidiary, which was organized as Delaware limited liability company on September 1, 2015. Our principal executive offices are located at 6501 Park of Commerce Boulevard, Suite 200, Boca Raton, FL 33487, and our telephone number is (877) 292-7660. Our corporate website is www.gnln.com. Information contained on our website is not incorporated by reference into this prospectus, and such information should not be considered to be part of this prospectus.

13

The Offering

| Issuer in this offering | Greenlane Holdings, Inc. | |

| Class A common stock offered by us | shares | |

| Class A common stock offered by the selling stockholders | shares | |

| Underwriters’ option to purchase additional shares of Class A common stock | The selling stockholders have granted the underwriters the right to purchase up to additional shares of Class A common stock within 30 days of the closing date of this offering. See “Underwriting.” | |

| Class A common stock to be outstanding immediately after this offering | shares, representing % of the voting interest and 100% of the economic interest in us, or shares, representing % voting interest and 100% of the economic interest in us if the underwriters exercise in full their option to purchase additional shares of Class A common stock. | |

| Class B common stock to be outstanding immediately after this offering | shares, representing % of the voting interest and no economic interest in us, or shares, representing % voting interest and no economic interest if the underwriters exercise in full their option to purchase additional shares of Class A common stock. | |

| Class C common stock to be outstanding immediately after this offering | shares, representing % of the voting interest and no economic interest in us, representing % voting interest and no economic interest if the underwriters exercise in full their option to purchase additional shares of Class A common stock. | |

| Common Units of Greenlane Holdings, LLC to be held by us immediately after this offering | Common Units, representing a % economic interest in the business of Greenlane Holdings, LLC, or Common Units, representing a % economic interest in the business of Greenlane Holdings, LLC, if the underwriters exercise in full their option to purchase additional shares of Class A common stock. | |

| Common Units of Greenlane Holdings, LLC to be held by the Members after this offering | Common Units, representing an % economic interest in the business of Greenlane Holdings, LLC, or Common Units, representing an % economic interest in the business of Greenlane Holdings, LLC, if the underwriters exercise in full their option to purchase additional shares of Class A common stock. | |

| Ratio of shares of Class A common stock to Common Units | Our amended and restated certificate of incorporation and the Greenlane Operating Agreement will require that we and Greenlane Holdings, LLC at all times maintain a one-to-one ratio between the number of shares of Class A common stock issued by us and the number of Common Units owned by us. |

14

| Ratio of shares of Class B common stock to Common Units | Our amended and restated certificate of incorporation and the Greenlane Operating Agreement will require that we and Greenlane Holdings, LLC at all times maintain a one-to-one ratio between the number of shares of Class B common stock owned by the Non-Founder Members and the number of Common Units owned by the Non-Founder Members. | |

| Ratio of shares of Class C common stock to Common Units | Our amended and restated certificate of incorporation and the Greenlane Operating Agreement will require that we and Greenlane Holdings, LLC at all times maintain a three-to-one ratio between the number of shares of Class C common stock owned by the Founder Members and the number of Common Units owned by the Founder Members. | |

| Permitted holders of shares of Class B common stock | Only the Non-Founder Members and their permitted transferees of Common Units as described herein will be permitted to hold shares of our Class B common stock. Shares of Class B common stock are transferable only together with an equal number of Common Units. See “Certain Relationships and Related Party Transactions—The Transactions—Greenlane Operating Agreement.” | |

| Permitted holders of shares of Class C common stock | Only the Founder Members, an entity controlled by the Founder Members and their permitted transferees of Common Units as described herein will be permitted to hold shares of our Class C common stock. Shares of Class C common stock are transferable only together with an equal number of Common Units. See “Certain Relationships and Related Party Transactions—The Transactions—Greenlane Operating Agreement” and “Description of Capital Stock—Class C Common Stock—Conversion.” | |

| Voting rights | Each share of our Class A common stock entitles its holder to one vote per share, representing an aggregate of % of the combined voting power of our issued and outstanding common stock upon the completion of this offering, or % if the underwriters exercise in full their option to purchase additional shares of Class A common stock. | |

| Each share of our Class B common stock entitles its holder to one vote per share, representing an aggregate of % of the combined voting power of our issued and outstanding common stock upon the completion of this offering, or % if the underwriters exercise in full their option to purchase additional shares of Class A common stock. | ||

| Each share of our Class C common stock entitles its holder to one vote per share, representing an aggregate of % of the combined voting power of our issued and outstanding common stock upon the completion of this offering, or % if the underwriters exercise in full their option to purchase additional shares of Class A common stock. | ||

| All classes of our common stock generally vote together as a single class on all matters submitted to a vote of our stockholders, except as otherwise required by law or our amended and restated certificate of incorporation. Upon the completion of this offering, our Class B common stock will be held exclusively by the Non-Founder Members and following the Class C Share Conversion, the Founder Members and our Class C common stock will be held exclusively by the Founder Members and an entity beneficially owned by the Founder Members. See “Description of Capital Stock.” |

15

| Voting power of the Members after this offering | %, or % if the underwriters exercise in full their option to purchase additional shares of Class A common stock. | |

| Voting power of our executive officers, directors and persons holding more than 5% of our Class A, Class B or Class C common stock (other than any purchasers in this offering) after this offering | %, or % if the underwriters exercise in full their option to purchase additional shares of Class A common stock. | |

| Redemption rights of holders of Common Units | The Members, from time to time following the completion of this offering, may require Greenlane Holdings, LLC to redeem all or a portion of their Common Units for newly-issued shares of Class A common stock on a one-to-one basis or, at our option, a cash payment equal to a volume weighted average market price of one share of our Class A common stock for each Common Unit redeemed (subject to customary adjustments, including for stock splits, stock dividends and reclassifications) in accordance with the terms of the Greenlane Operating Agreement. Our decision to make a cash payment upon a Member’s redemption election will be made by our independent directors (within the meaning of the applicable securities laws) who are disinterested. See “Certain Relationships and Related Party Transactions—The Transactions—Greenlane Operating Agreement.” Shares of our Class B common stock and Class C common stock, as the case may be, will be cancelled, without consideration, on a one-to-one basis in the case of our Class B common stock or a three-to-one basis in the case of our Class C common stock if we, at the election of a Member, redeem or exchange Common Units of such Member pursuant to the terms of the Greenlane Operating Agreement. | |

| Use of proceeds | We intend to use the net proceeds received by us from this offering to purchase Common Units (assuming an initial offering price per share of Class A common stock in this offering of $ per share, the midpoint of the price range set forth on the cover page of this prospectus) directly from Greenlane Holdings, LLC at a price per Common Unit equal to the initial public offering price per share of Class A common stock in this offering, less underwriting discounts and commissions. We will not receive any proceeds from the sale of Class A common stock by the selling stockholders, including any shares sold to the underwriters upon exercise of their right to purchase additional shares of Class A common stock. We will receive Common Units from the selling stockholders in exchange for the shares of Class A common stock to be sold by the selling stockholders in this offering. | |

| We intend to cause Greenlane Holdings, LLC to use the proceeds from the sale of Common Units to us to pay the expenses of this offering and for acquisitions of complementary businesses, acquisitions of proprietary brands, dispensary service infrastructure and licenses, capital expenditures for operations and warehouses and other facilities, inventory investment, and working capital and general corporate purposes. See “Use of Proceeds.” |

16