Q4 2020 Earnings call

Greenlane and kushco to merge to create Leading ancillary cannabis Products and Services company March 31, 2021 Optional color palette

DISCLAIMER Cautionary Statement Regarding Forward-Looking Statements This presentation includes forward-looking statements. These forward-looking statements generally can be identified by phrases such as “will,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates” or other words or phrases of similar import. These forward-looking statements include, without limitation, Greenlane’s and KushCo’s expectations with respect to future performance and anticipated financial results of the merger and the timing of completion. These statements are based on current expectations, estimates and projections about the industry, markets in which Greenlane and KushCo operate, management’s beliefs, assumptions made by management and the transactions described in this presentation. While Greenlane’s and KushCo’s management believes the assumptions underlying the forward-looking statements and information are reasonable, such information is necessarily subject to uncertainties and may involve certain risks, many of which are difficult to predict and are beyond management’s control. These risks include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (2) the outcome of any legal proceedings that may be instituted against the parties and others following announcement of the merger agreement; (3) the inability to consummate the transaction due to the failure to obtain the requisite stockholder approvals or the failure to satisfy other conditions to completion of the transaction; (4) risks that the proposed transaction disrupts current plans and operations of Greenlane and KushCo; (5) the ability to recognize the anticipated benefits of the transaction; and (6) the amount of the costs, fees, expenses and charges related to the transaction; and the other risks and important factors contained and identified in Greenlane’s and KushCo’s filings with the Securities and Exchange Commission (“SEC”), such as their respective Annual Reports on Form 10-K for the fiscal year ended December 31, 2020, and August 31, 2020, respectively, any of which could cause actual results to differ materially from the forward-looking statements in this communication. There can be no assurance that the merger will in fact be consummated. We caution investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this presentation. Neither Greenlane nor KushCo is under any duty to update any of these forward-looking statements after the date of this communication, nor to conform prior statements to actual results or revised expectations, and neither Greenlane nor KushCo intends to do so. Important Information for Investors and Stockholders In connection with the proposed transaction, Greenlane expects to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of Greenlane and KushCo that also constitutes a prospectus of Greenlane, which joint proxy statement will be mailed or otherwise disseminated to Greenlane’s and KushCo’s respective stockholders when it becomes available. Greenlane and KushCo also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of the registration statement and the joint proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by Greenlane and KushCo with the SEC at the SEC’s website at www.sec.gov. Copies of the documents filed by the companies will be available free of charge on their respective websites at www.gnln.com and www.kushco.com. Participants in Solicitation Greenlane, KushCo and their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Greenlane is set forth in its proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on April 24, 2020. Information about the directors and executive officers of KushCo is set forth in its proxy statement for its 2021 annual meeting of stockholders, which was filed with the SEC on December 28, 2020. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Established Platform Well-Positioned to Capitalize on Industry Tailwinds Enhanced Portfolio Depth and Innovation Pipeline to Deliver Value to Customers and Consumers A leader in cannabis accessories and ancillary services 1 Complementary Portfolio of Brands, Products & Services Offer Significant Cross-selling Opportunities Experienced Industry Leaders with 25+ Years of Cannabis Operating Experience Combined Pro Forma 2020 Revenue Estimated to be Over $250 Million Positioned to Serve the Entire Value Chain from Leading Operators to Retail and Consumers Improved Margins and Meaningful Potential Synergies Expected to Drive Immediate Profitability

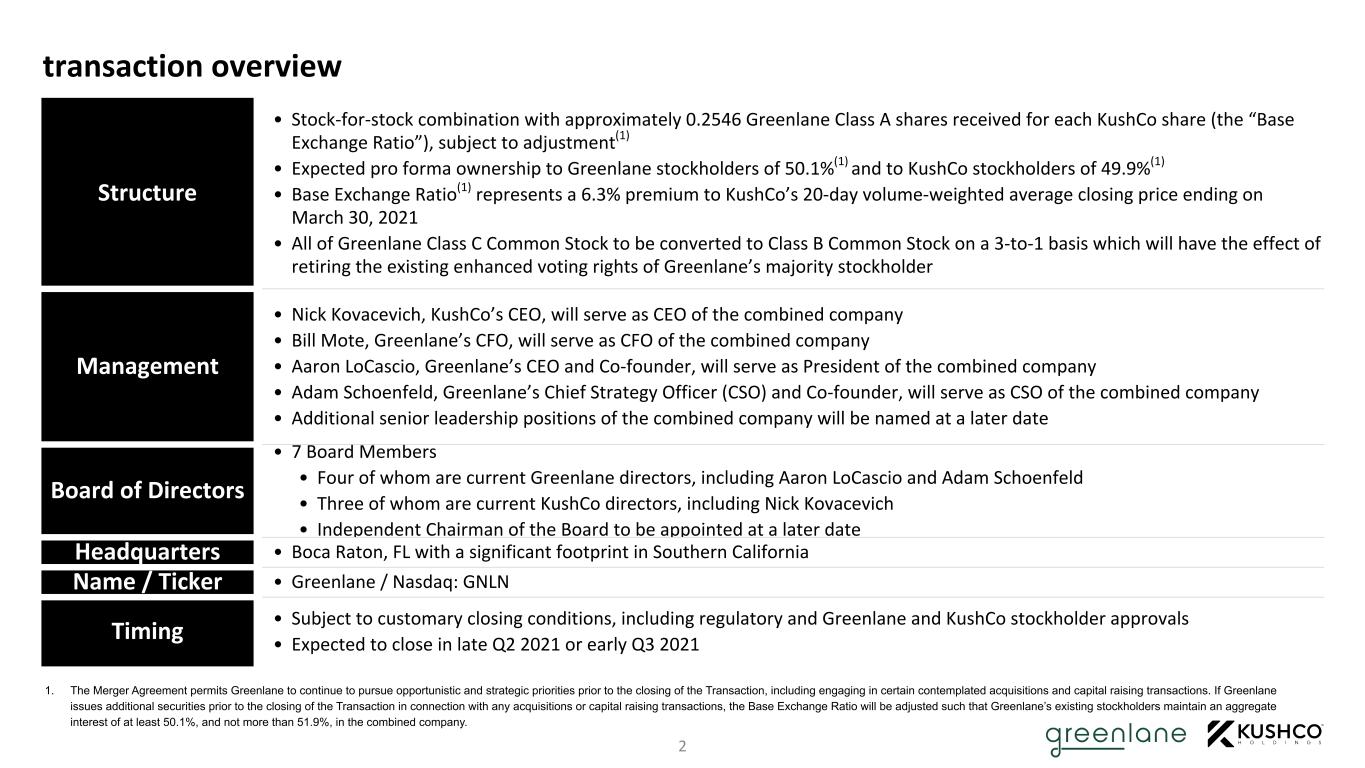

Structure • Stock-for-stock combination with approximately 0.2546 Greenlane Class A shares received for each KushCo share (the “Base Exchange Ratio”), subject to adjustment(1) • Expected pro forma ownership to Greenlane stockholders of 50.1%(1) and to KushCo stockholders of 49.9%(1) • Base Exchange Ratio(1) represents a 6.3% premium to KushCo’s 20-day volume-weighted average closing price ending on March 30, 2021 • All of Greenlane Class C Common Stock to be converted to Class B Common Stock on a 3-to-1 basis which will have the effect of retiring the existing enhanced voting rights of Greenlane’s majority stockholder Management • Nick Kovacevich, KushCo’s CEO, will serve as CEO of the combined company • Bill Mote, Greenlane’s CFO, will serve as CFO of the combined company • Aaron LoCascio, Greenlane’s CEO and Co-founder, will serve as President of the combined company • Adam Schoenfeld, Greenlane’s Chief Strategy Officer (CSO) and Co-founder, will serve as CSO of the combined company • Additional senior leadership positions of the combined company will be named at a later date Board of Directors • 7 Board Members • Four of whom are current Greenlane directors, including Aaron LoCascio and Adam Schoenfeld • Three of whom are current KushCo directors, including Nick Kovacevich • Independent Chairman of the Board to be appointed at a later date Headquarters • Boca Raton, FL with a significant footprint in Southern California Name / Ticker • Greenlane / Nasdaq: GNLN Timing • Subject to customary closing conditions, including regulatory and Greenlane and KushCo stockholder approvals • Expected to close in late Q2 2021 or early Q3 2021 transaction overview 2 1. The Merger Agreement permits Greenlane to continue to pursue opportunistic and strategic priorities prior to the closing of the Transaction, including engaging in certain contemplated acquisitions and capital raising transactions. If Greenlane issues additional securities prior to the closing of the Transaction in connection with any acquisitions or capital raising transactions, the Base Exchange Ratio will be adjusted such that Greenlane’s existing stockholders maintain an aggregate interest of at least 50.1%, and not more than 51.9%, in the combined company.

Vape Hardware & Technology Packaging and Supplies Consumer Goods Services Offering 1 of 4 Exclusive CCELL Distributors in the U.S. Leading brands in premium vape, spanning all product types Premium, customizable child-resistant packaging Leader in child-resistant, compatible, fully-customizable and CBD packaging Value-oriented offering and deep relationships with the leading MSOs in the U.S.Papers & Wraps | Functional Glass | Grinders & Storage | Tools & Appliances | Parts & Accessories • Product Development • Go-to-market Strategy • Sales & Marketing Support • Direct-to-consumer Fulfillment • Supply Chain Management • Energy + Natural Products • CBD Services • Equipment Financing Highly complementary offering of brands, products & services 3 Premium Offering

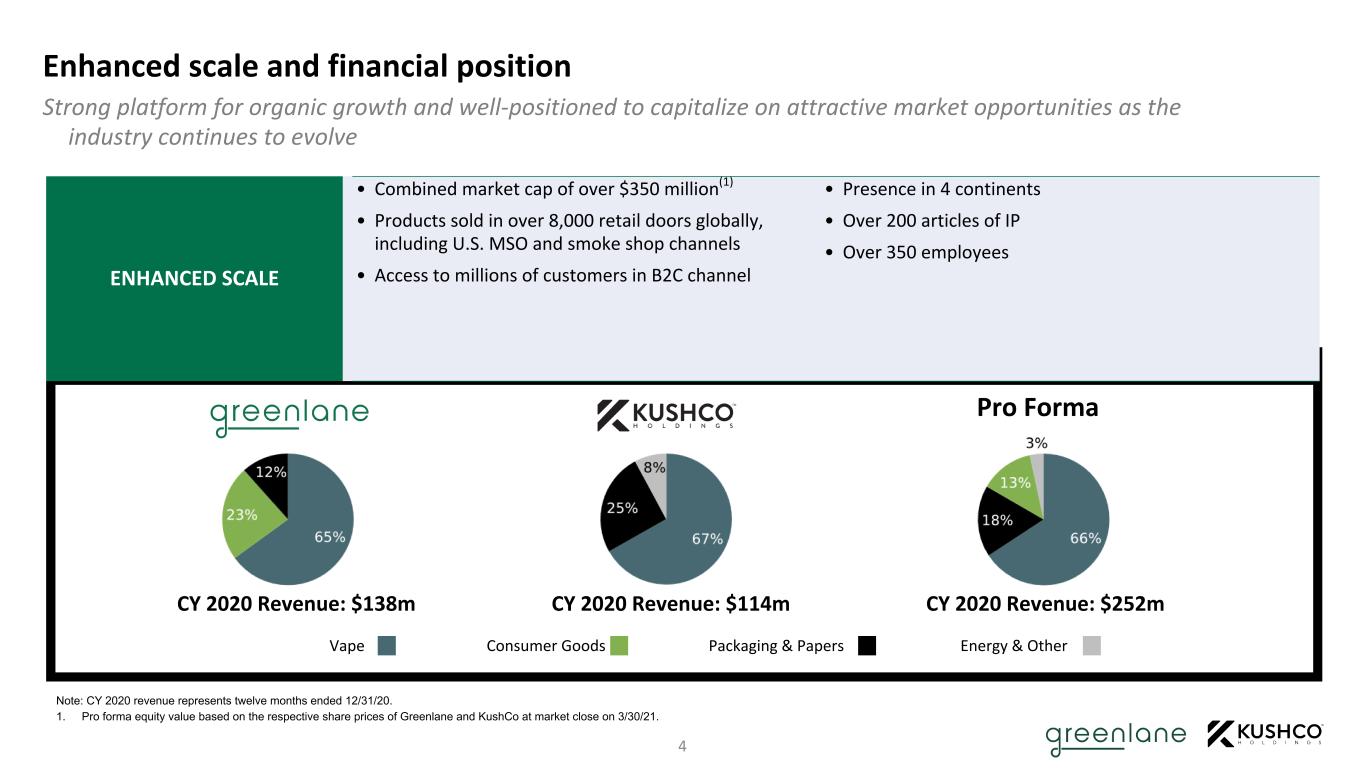

Complementary Revenue Base Enhanced scale and financial position 4 Note: CY 2020 revenue represents twelve months ended 12/31/20. 1. Pro forma equity value based on the respective share prices of Greenlane and KushCo at market close on 3/30/21. CY 2020 Revenue: $138m CY 2020 Revenue: $114m CY 2020 Revenue: $252m Pro Forma Vape Consumer Goods Packaging & Papers Energy & Other Strong platform for organic growth and well-positioned to capitalize on attractive market opportunities as the industry continues to evolve ENHANCED SCALE • Combined market cap of over $350 million(1) • Products sold in over 8,000 retail doors globally, including U.S. MSO and smoke shop channels • Access to millions of customers in B2C channel • Presence in 4 continents • Over 200 articles of IP • Over 350 employees

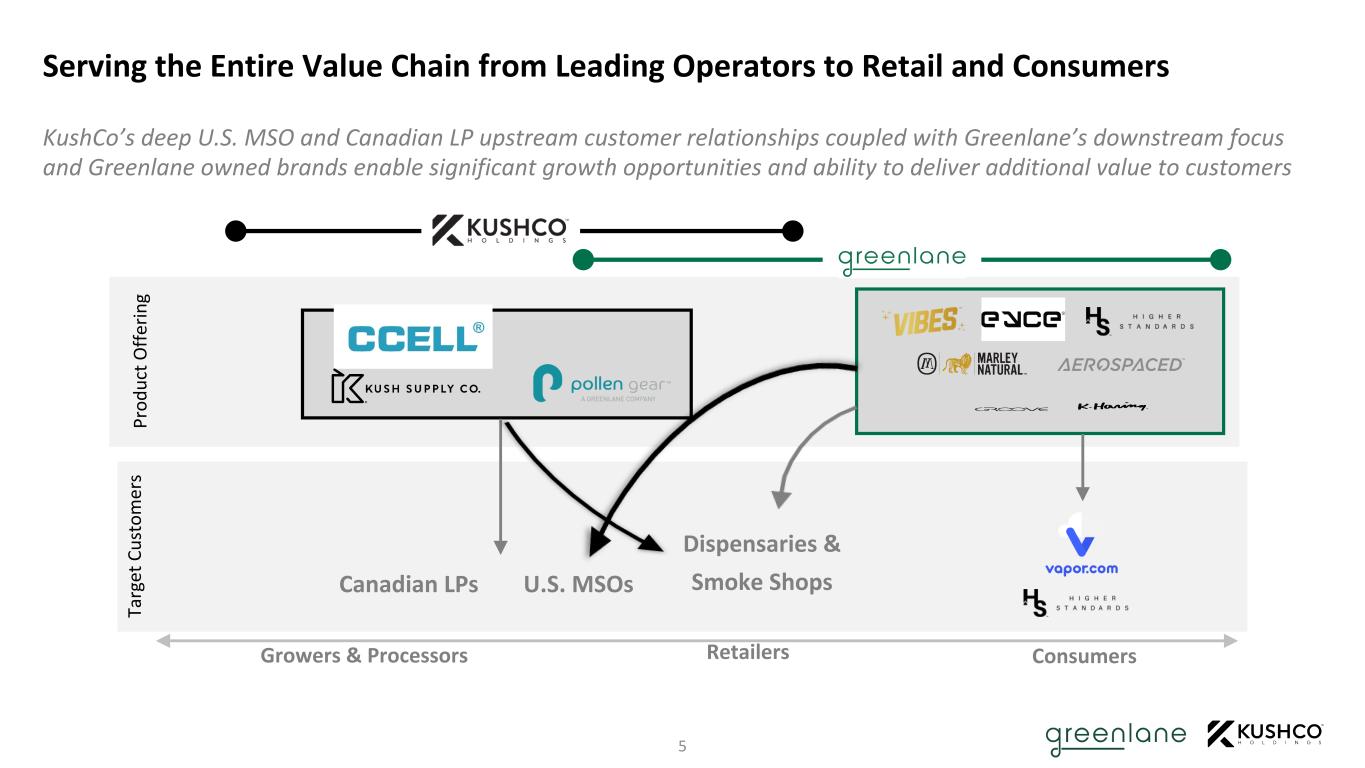

Serving the Entire Value Chain from Leading Operators to Retail and Consumers 5 Growers & Processors Retailers Consumers Ta rg et C u st o m er s P ro d u ct O ff er in g KushCo’s deep U.S. MSO and Canadian LP upstream customer relationships coupled with Greenlane’s downstream focus and Greenlane owned brands enable significant growth opportunities and ability to deliver additional value to customers Dispensaries & Smoke Shops U.S. MSOsCanadian LPs

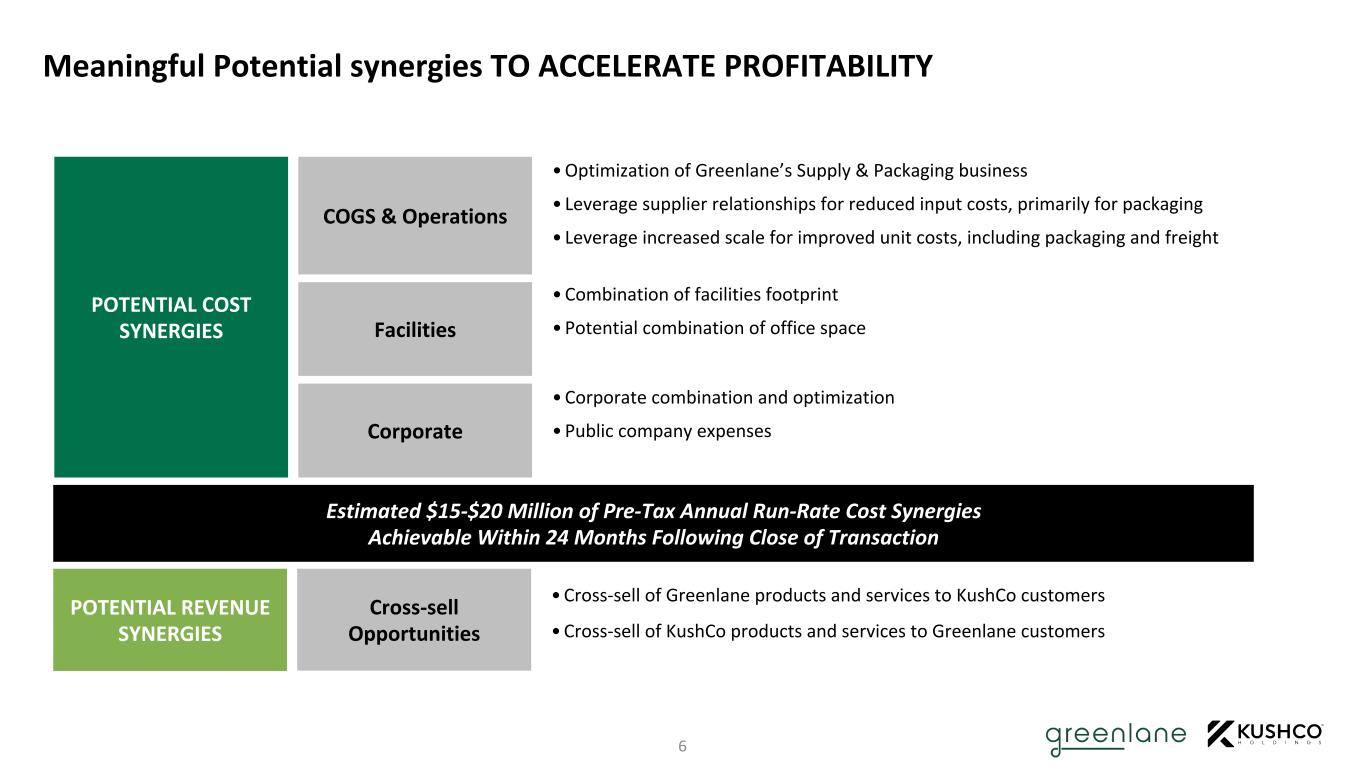

Meaningful Potential synergies TO ACCELERATE PROFITABILITY 6 POTENTIAL COST SYNERGIES COGS & Operations Facilities Corporate •Optimization of Greenlane’s Supply & Packaging business • Leverage supplier relationships for reduced input costs, primarily for packaging • Leverage increased scale for improved unit costs, including packaging and freight •Combination of facilities footprint • Potential combination of office space •Corporate combination and optimization •Public company expenses Estimated $15-$20 Million of Pre-Tax Annual Run-Rate Cost Synergies Achievable Within 24 Months Following Close of Transaction POTENTIAL REVENUE SYNERGIES Cross-sell Opportunities •Cross-sell of Greenlane products and services to KushCo customers •Cross-sell of KushCo products and services to Greenlane customers

Cannabis Legalization Process • Arizona, New Jersey, Montana and South Dakota passed adult-use legislation in November 2020 • Mississippi passed medical in November 2020 • Virginia passed adult-use legislation in February 2021, to begin in 2024 • New York legislators reached agreement in March 2021 to legalize adult-use Capital Inflows Returning • Additional capital availability has allowed customer base to deploy capital for growth into new states Rebound from COVID, EVALI and Nicotine Winddown • Temporary negative headwinds over the past seven quarters have been overcome or are clearing Well-Positioned to Capitalize on Macro Tailwinds 7 Given the differentiated customer offering, the combined company is poised for growth with its customer base having overcome temporary but sequential and rapidly expanding headwinds Uniquely positioned to serve the leading operators as they continue their rapid expansion

Experienced Industry Leaders 8 25+ years of operating history in the ancillary cannabis industry

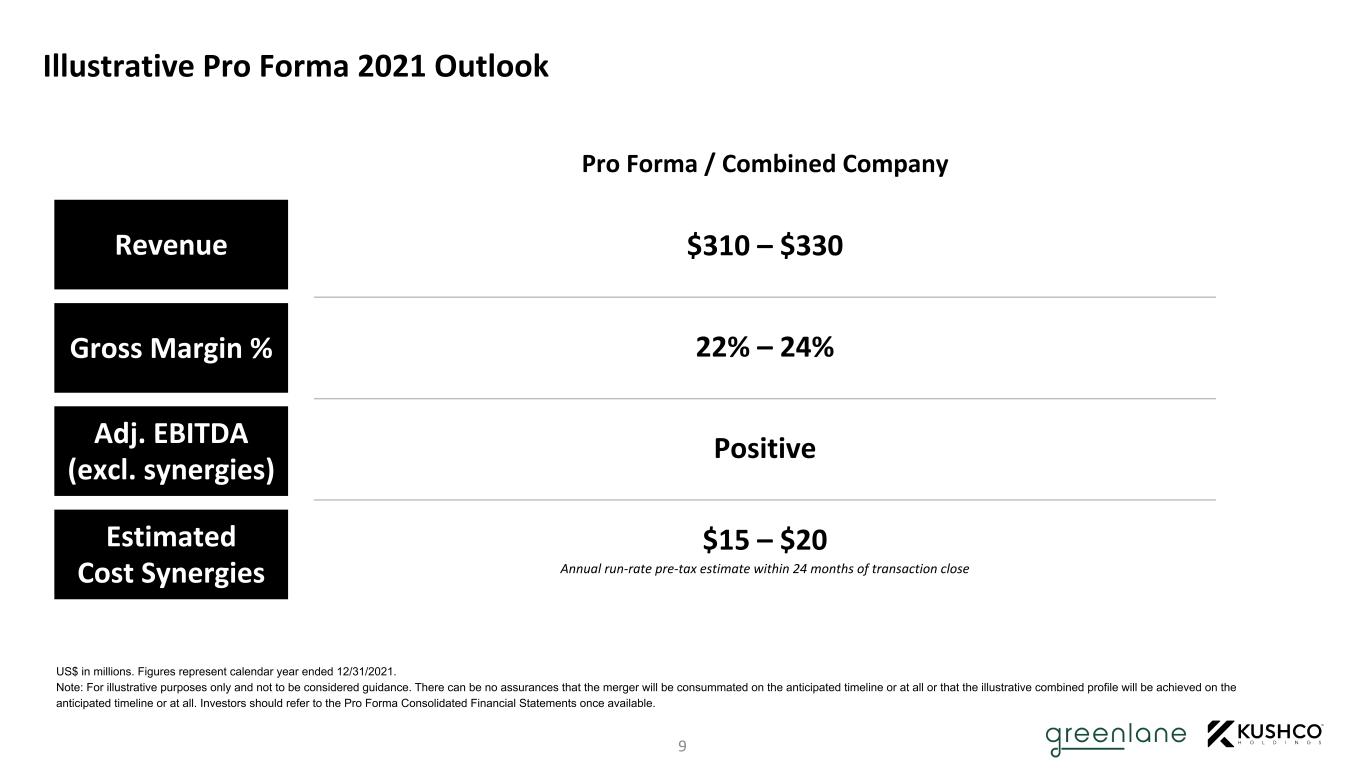

Pro Forma / Combined Company $310 – $330 22% – 24% Positive $15 – $20 Annual run-rate pre-tax estimate within 24 months of transaction close Revenue Gross Margin % Adj. EBITDA (excl. synergies) US$ in millions. Figures represent calendar year ended 12/31/2021. Note: For illustrative purposes only and not to be considered guidance. There can be no assurances that the merger will be consummated on the anticipated timeline or at all or that the illustrative combined profile will be achieved on the anticipated timeline or at all. Investors should refer to the Pro Forma Consolidated Financial Statements once available. Estimated Cost Synergies Illustrative Pro Forma 2021 Outlook 9